- Wednesday, March 12, 2025

By: Shubham Ghosh

WHILE experts have expressed concerns over the falling Indian rupee vis-a-vis the US dollar, the country’s finance minister has pointed out various factors such as the Ukraine war and rising crude oil prices that have caused the currency to witness the fall.

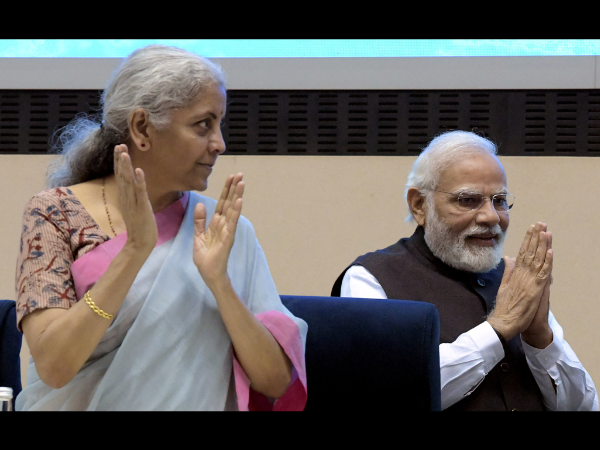

Nirmala Sitharaman on Monday (18) said in a written response to a lawmaker’s question over the rupee’s fall, “Global factors such as the Russia-Ukraine conflict, soaring crude oil prices and tightening of global financial conditions are the major reasons for the weakening of the Indian rupee against the US dollar.”

The minister was responding on the inaugural day of the monsoon session of the parliament.

“Currencies such as the British pound, the Japanese yen and the euro have weakened more than the Indian rupee against the US dollar and therefore the Indian rupee has strengthened against these currencies in 2022.”

She added that the depreciation of a currency is likely to improve export competitiveness while making imports expensive.

The Reserve Bank of India, India’s central bank, regularly monitors the foreign-exchange market and chips in in cases of excess volatility and India has seen a rise in interest rates in recent months that heighten the attractiveness of holding the rupee for both residents and non-residents, Sitharaman, one of the most prominent faces of the Narendra Modi government, said.

The RBI has undertaken several measures to guard the rupee which has tumbled to record lows against the American currency in the recent days. It is still trading close to the psychologically upsetting 80 mark vis-a-vis the dollar.

Sitharaman also added that monetary tightening in the advanced economies, particularly in the US, tends to make foreign investors withdraw funds from the emerging markets. She said foreign portfolio investors have withdrawn around $14 billion from the Indian equity markets so far in this fiscal.