- Tuesday, April 22, 2025

The central banker declined to comment on interest rates and maintained that the rate-setting panel will take an appropriate call on it at its next meeting in December

By: Shajil Kumar

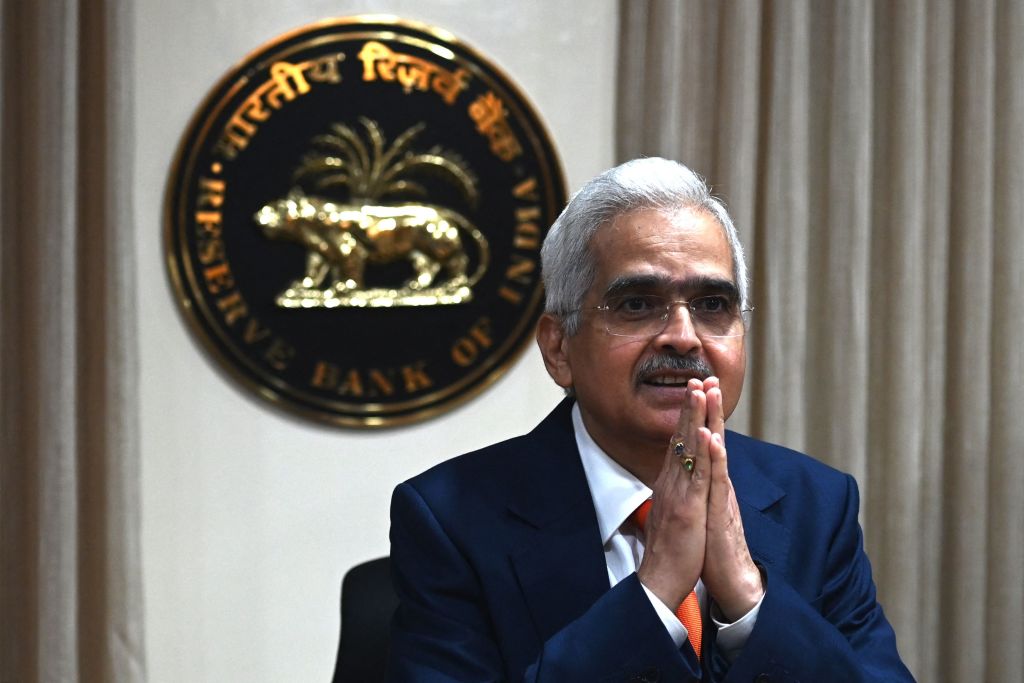

RESERVE BANK governor Shaktikanta Das on Thursday said the Indian economy has been sailing “smoothly” amid the global headwinds.

Speaking at an event organised by CNBC-TV18 here, Das declined to comment on a suggestion by union commerce minister Piyush Goyal for a rate cut, maintaining that the rate-setting panel will take an appropriate call on it at its next meeting in December.

In comments made days after headline inflation shot up beyond the 6 per cent tolerance band of RBI for October, Das said inflation is “expected to moderate despite periodic humps”.

The Governor said the domestic economy has sailed very well through the prolonged period of turbulence in the recent past exhibiting resilience, but added that there are a slew of headwinds prevailing in the global economy right now like rising bond yields, commodity prices showing a divergence and a contradiction of financial markets showing resilience despite rising geopolitical risks.

“The Indian economy is sailing smoothly, powered by buffers like strong macroeconomic fundamentals, a stable financial system and a resilient external sector,” said the bureaucrat-turned-central banker, who will be completing six years at the helm at RBI soon.

With the rupee hitting new lows, Das said India’s external sector has exhibited “strength and stability” in the recent period as seen in the current account deficit remaining at a manageable level, merchandise exports starting to grow, and service exports growth being strong.

He reminded that the country has the fourth largest forex reserves in the world. The forex reserves, which stood at $682 billion (£539.14bn)as of October 31, are sufficient to cover the entire external debt and a year’s import payments, he added.

The Governor also made it clear that the RBI does not target a rate for the rupee, and the fore interventions are for ensuring orderly movement and curbing volatility in the currency.

On the issue of rates, Das said the change in the stance to “neutral,” from the “withdrawal of adoption” adopted unanimously by the rate-setting panel at its last meeting in October, provides “greater flexibility and optionality to act in sync with the evolving conditions and the outlook.”

He said the receding headline inflation in FY23 and the first half of FY25 is representative of the successes of RBI’s policies, and underlined that the actions did not undermine financial stability.

Das said a sound regulatory framework for the regulated entities together with robust supervision is a key enabler of financial stability.

There is a continuing need for the financial sector entities to strengthen their levels of levels and also the quality of capital, while further sharpening the risk management standards, he said. (PTI)