- Wednesday, October 09, 2024

The central bank maintained status quo despite the US Federal Reserve lowering the benchmark rates by 50 basis points last month

By: Shajil Kumar

THE RESERVE Bank of India (RBI) on Wednesday decided to keep the policy rate unchanged for the tenth time in a row but changed its stance to ‘neutral’ that may lead to a cut in the forthcoming policies.

RBI maintained the status quo despite the US Federal Reserve lowering the benchmark rates by 50 basis points last month. The central banks of some developed nations have also reduced their interest rates.

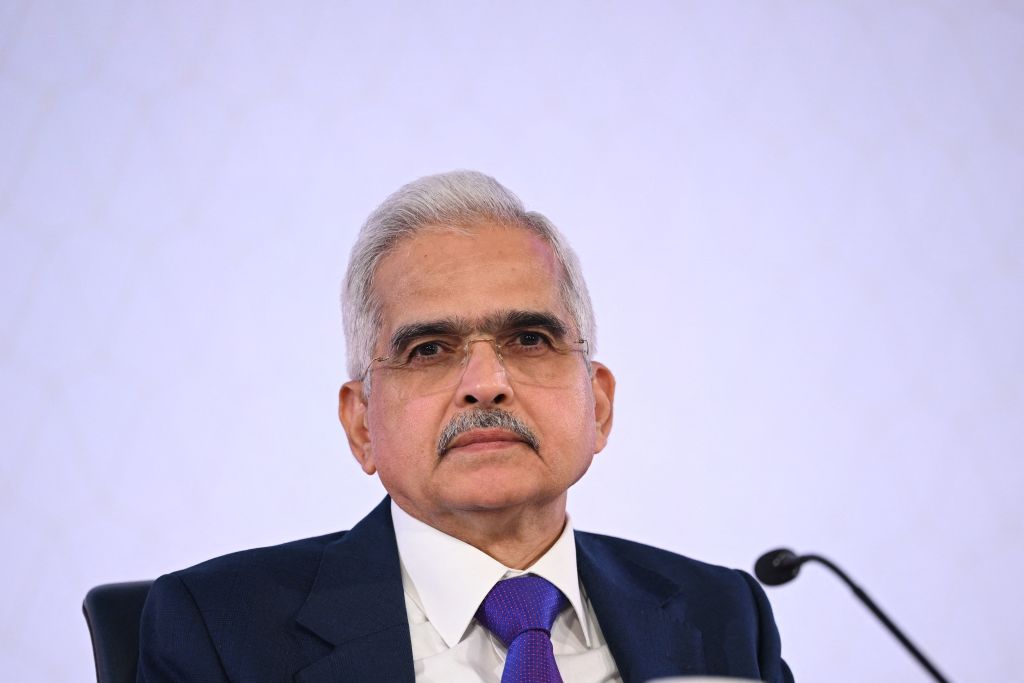

Announcing the fourth bi-monthly monetary policy for the current financial year, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 6.5 per cent.

The RBI has maintained the status quo on benchmark interest rate since February 2023.

Das said RBI will remain watchful of elevated food inflation even when India GDP growth remains strong.

This was the first meeting of the reconstituted MPC. The three newly-appointed external members are Ram Singh, Saugata Bhattacharya and Nagesh Kumar.

The MPC was reconstituted by the government last month.

Inflation forecast

The central bank retained the retail inflation projection at 4.5 per cent for fiscal 2024-25, with Governor Shaktikanta Das stressing that it will have to closely monitor the price situation and keep the “inflation horse” under tight leash lest it may bolt again.

Unveiling the October bi-monthly monetary policy, the Governor also said the flexible inflation targeting (FIT) framework has completed 8 years since its introduction in 2016 and is a major structural reform of the 21st century in India.

Under the FIT, the central bank has ensured that the consumer price index (CPI) based retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

The RBI on Wednesday retained the CPI inflation projection for 2024-25 at 4.5 per cent, with Q2 at 4.1 per cent; Q3 at 4.8 per cent; and Q4 at 4.2 per cent.

CPI inflation for Q1:2025-26 is projected at 4.3 per cent. The risks are evenly balanced. (PTI)